Global Tax, Sarkozy leaning Left - Sarkozy to press for 'Tobin Tax'

Source: news.bbc.co.uk

Nicolas Sarkozy will try to rally G20 leaders behind the idea of a Tobin Tax

French President Nicolas Sarkozy will urge fellow G20 leaders to introduce a special tax to reduce risky behaviour by banks, the BBC has learned.

Mr Sarkozy wants a levy known as a Tobin Tax to be applied to every financial transaction.

The move is aimed at cutting excessively speculative trades and encouraging long-term decision-making.

But senior EU officials told the BBC that the chances of getting a global agreement were "less than minimal".

The proposal does not yet have the formal backing of the EU or Germany - France's largest trading partner - and according to the BBC's business reporter Joe Lynam, it is widely expected to face resistance from Britain and the US, home to the world's largest financial centres.

The BBC has also learnt that the issue of bankers' pay, especially bonuses, will also be on the agenda at the G20 meeting in Pittsburgh, the US, next weekend.

There will be no suggestion of capping individual bonuses, our correspondent says, but it is likely that overall bonuses as a proportion of a company's earnings could be restricted.

There may also be a possibility of payment deferral and the option of clawing payments back should decisions by bankers prove to have been excessively risky or erroneous

Old idea resurrected

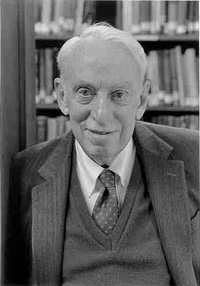

James Tobin |

While it was originally supposed to be used for aid for developing countries, it could now be used to fund some of the bailouts in the financial industry or the multi-billion dollar stimulus packages under way to kick-start economies around the world.

Ed Comment: ATTAC (Association for the Taxation of Financial Transactions for the Aid of Citizens) originally a single-issue movement demanding the introduction of the so-called Tobin tax on currency speculation.

"Lord" Turner |

"Such taxes have long been the dream of development economists and those who care about climate change - a nice sensible revenue source for funding global public goods," Lord Turner told Prospect magazine.

According to our correspondent, the notion of a Tobin Tax is likely to be referred by the G20 to the Financial Stability Forum - the club of the world's top central bankers and financial regulators - to assess and translate into a workable set of rules to which all countries might be able to agree.

But its proponents face a tough battle.

Speaking in Brussels last Thursday, British Prime Minister Gordon Brown voiced doubts about whether a worldwide tax was practical.

"If one or two countries refuse to adopt a common levy or action or taxation, then it makes it very difficult to implement," he said.

"If flows are under supervision in one set of countries, but not under supervision in other countries, then it makes it easy for people to avoid the action that even is agreed by most of the countries in the world."

Source: news.bbc.co.uk

EU likes Tobin tax, but idea needs work

From: theglobeandmail.com

Here is Joaquín Almunia from the Socialist Workers' Party in Spain, taking orders

European Commission's top economic official says support for the idea exists in different parts of Europe

A “Tobin tax” on world financial transactions is an excellent idea but needs work before it could be put into practice, the European Commission's top economic official said on Friday.

“Putting a tax on international financial transactions seems a very sensible idea to me,” said economic and monetary affairs commissioner Joaquin Almunia. “I think that for it to be feasible it will need work,” he said at a breakfast meeting, adding that in Europe he had heard “many voices in favour”.

French Foreign Minister Bernard Kouchner has suggested such a tax to fund development, despite a recent rejection of the idea by finance minister Christine Lagarde.

Mr. Kouchner told business daily Les Echos on Thursday that British Foreign Minister David Milliband was also in favour of the idea, which would meet with stiff resistance from financiers. Mr. Kouchner said a tax of 0.005 per cent on financial transactions could bring in €20-€30-billion a year for development.

U.S. economist James Tobin was the first to suggest a tax on currency trades as a way of reducing speculation and volatility.

Source: theglobeandmail.com