An Unknown Billionaire's Quest To Reverse Aging

If you Google Osman Kibar’s name you’ll find pictures of him playing poker. It’s not that he was ever a serious player–just that in 2006 he won the first poker tournament he ever played in and then, a year later, came in second out of 3,000 players at a tournament run by the World Series of Poker in Vegas.

“I don’t get this,” he told a friend. “I’m going to enter another tournament just to check this assumption.” So he played one more tournament, won it and then quit. “While I’m playing, it’s you and the other players,” says Kibar, 45. “The cards are irrelevant. [But] when you just stare at cards 12 to 14 hours a day, you get this hangover effect.” He couldn’t think straight for days, he says, so he gave it up. Instead, for fun, he now reads higher-math textbooks and meditates.

Kibar, an engineering Ph.D. who emigrated from Turkey to the U.S. for college, doesn’t need to bet on cards for money. Samumed, the San Diego firm he has been stealthily building for a decade, is the most valuable biotechnology startup on the planet.

Based on investments made by private investors that include IKEA’s private venture firm, anonymous high-net-worth individuals and a single venture capital firm, Samumed has raised $220 million, and the most recent round of financing valued it at $6 billion. It is halfway through raising another $100 million at a $12 billion valuation. Kibar owns a third of the company, which would give him a net worth of $4 billion.

Samumed is finding it easy to raise huge amounts of cash because it believes it has invented medicines that can reverse aging. Its first drugs are targeted at specific organ systems. One aims to regrow hair in bald men. The same drug may also turn gray hair back to its original color, and a cosmetic version could erase wrinkles. A second drug seeks to regenerate cartilage in arthritic knees. Additional medicines in early human studies aim to repair degenerated discs in the spine, remove scarring in the lungs and treat cancer. After that Samumed will attempt to cure a leading cause of blindness and go after Alzheimer’s. The firm’s focus, disease by disease, symptom by symptom, is to make the cells of aging people regenerate as powerfully as those of a developing fetus.

It’s exciting but also incredibly speculative. The studies so far indicate that the drugs seem pretty safe, may regrow hair and seem to ease pain and improve function in people with knee arthritis. But it’s crucial to remember that 80% of new drugs that reach this stage of research fail to make it to market. And that valuation? It’s insane. The most valuable publicly traded biotechnology company without approved drugs is worth “just” $6 billion. And at this point everybody in biotechnology worries about investing in the next Theranos, the blood-testing company that private investors valued at $9 billion before the accuracy of its tests was challenged.

So the question is: Has Osman Kibar found a pharmaceutical fountain of youth, or is he simply one of the most talented poker players the world has ever known?

Kibar was born in Izmir, Turkey, across from the Greek Islands, on the Aegean Coast. It is a warm, beautiful place, and to this day he gets depressed in cold weather. After elementary school he went to Robert College in Istanbul, an elite school that drew from among the top 0.2% of students who took Turkey’s national standardized test at age 11.

Robert College was the prelude to Samumed: It was where Kibar befriended the boys who would eventually become his chief financial officer, chief legal officer and chief medical officer. He then went to California, picked for its climate, to study at Pomona College (B.A., mathematical economics, 1991), Caltech (B.S., engineering, 1993) and UC San Diego (Ph.D., biophotonics, 1999). While in grad school he founded a biotech, Genoptix, which was sold to Novartis for $470 million in 2011. He also cofounded E-Tenna, which made antennas for the wireless industry and was split up and sold to Intel and Titan Corp. He had no management role in either.

Kibar quit academia because he felt it was too bureaucratic and moved to New York to work at Pequot Capital scouting new technology ventures. His Robert College friends were there, and they met for weekly basketball games. But as careers took off and families got started, the games slowed, and Kibar grew disenchanted with his role at Pequot, as the firm became less interested in bleeding-edge tech. “I woke up one morning, and I was an investment banker,” he says.

So he decided to go back to San Diego, where the weather didn’t make him want to stay in bed all day. In an airport in Turkey he ran into one of his Robert College pals, Cevdet Samikoglu, a banker who, after a stint at Goldman Sachs, had become a partner at Greywolf Capital, the powerful $3.6 billion hedge fund.

On the back of a boarding pass Kibar sketched out his investment strategy, which involved focusing only on technologies that could have world-changing impact. After that meeting Samikoglu helped him secure $3.5 million to create new startups. One, housed in a Pfizer incubator, was called Wintherix. It would eventually become Samumed.

But the Pfizer deal that created Wintherix ended in conflict. After two years Pfizer decided not to go forward with Wintherix’s drugs, and the companies sued each other. Wintherix sneaked out of the Pfizer incubator over the course of a weekend. One Wintherix employee swiped into the building 130 times to move stuff out.

In a 2010 complaint Pfizer alleged that Kibar did a round of financing that diluted the drug giant’s stake in Wintherix from 60% to 2.6%. Wintherix countered that Pfizer was deliberately trying to drive it out of business by preventing fundraising so Pfizer could buy it on the cheap.

During the battle, Wintherix’s bank balance shrank to $9,000. But Kibar found money. His brother-in-law, Ugur Bayar, the CEO of Credit Suisse Turkey, was the lead investor in a $2.4 million friends-and-family round. In 2012 the Pfizer suit was settled in a way that gave Wintherix the right to the drugs. Kibar renamed the company Samumed, after a Zen term, samu, that means meditating through everyday tasks like gardening or chopping wood.

Someone at Pfizer was impressed: VenBio venture capitalist Corey Goodman, who was on Pfizer’s executive team at the time of the legal battle, has advised Samumed and has a small position in the company.

As the lawsuit wrapped up, Kibar called Samikoglu again. “What are you doing right now?” Kibar asked. Samikoglu responded that he was investing his own money in Turkey. He’d returned home to care for his mother, who had cancer, but she had died. “Okay, you’re not doing anything,” Kibar said. “Come help me.”

Samikoglu became Samumed’s chief financial officer and made another investment in the company. Nervous, Samikoglu called another Robert College friend, Yusuf Yazici, now a top NYU rheumatologist. Did Kibar’s science make any sense? Samikoglu asked. He arranged for a 15-minute phone call with Kibar that lasted an hour. During the call Yazici texted him: “You have to get me in on this. Osman has found the God pill.”

Another Robert College friend, Arman Oruc, left a partnership at white-shoe law firm Simpson Thacher & Bartlett to become chief legal officer. He forgot to even negotiate his salary before moving to San Diego. Then Yazici joined, as chief medical officer. “This crap had better work,” Samikoglu was told by his wife when Yazici signed up. “Now you’re starting to involve people I really like.”

What did Kibar have, that got his high school friends, all of them already incredibly successful, to join him at salaries of about $300,000 a year, with no management bonuses? A lot of it had to do with Samumed’s chief scientific officer and cofounder, John Hood.

Hood, 49, had invented a cancer drug that got his previous company, Targegen, bought by Sanofi for $635 million. He has a distinct take on drug development: He thinks everybody takes too many shortcuts and insists on doing work himself that other companies outsource, including formulating drug chemistry, testing drugs in laboratory animals and running clinical trials.

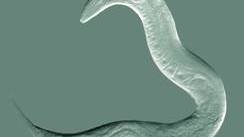

The target Hood and Kibar went after was obvious: a gene called Wnt, which stands for “wingless integration site,” because when you knock it out in fruit flies, they never grow wings. It’s a linchpin in a group of genes that control the growth of a developing fetus–whether you’re a fly or a person. Together these genes are known as the Wnt pathway. Trigger the right ones and you might revive old flesh. Some cancers do their dirty work by hijacking Wnt, and blocking it might stop tumors.

Most other researchers who had searched for Wnt drugs used one of biomedicine’s workhorses: a cell line derived from an aborted fetus in the Netherlands in 1973. Those fetal cells are easy to use in the lab, but over the intervening decades they have become very different from normal cells in humans. Hood opted to look for drug targets in colorectal cancer cells that expressed Wnt, comparing them with healthy colon cells that didn’t. It took almost three years.

Exactly what did Hood find? Samumed isn’t quite saying. Normally a patent explains which chemicals a drug targets. But in 2013 the Supreme Court said that genes aren’t patentable–the case involved a test for a gene variant that causes breast cancer–a ruling Samumed interprets as saying the company can have its patents while keeping those biochemical pathways under wraps. “That is our trade secret,” says Kibar. “That is our bread and butter.”

For scientists, this is a huge problem. “There is always a tradeoff,” says Roel Nusse, a Wnt expert at Stanford. “It is hard to find a molecule that is always going to affect disease but not normal tissues. To calibrate the balance, you have to know what the mechanism is.” Kibar says only academics and rivals care.

What the company will show is the animal and human data for its baldness and arthritis treatments. In mice and mini-pigs that have had hair removed, it grows back. Experiments in arthritis involve cutting the ligaments in the knees of rats so that the cartilage is destroyed. Samumed’s drug regrows the cartilage, and the rats can walk again.

Animal studies are a dime a dozen, though. “I’ve seen dozens of these animal results that don’t translate into clinical results,” says Nancy Lane, a rheumatologist at UC Davis who is a paid advisor to Samumed.

So what happens in people? In March Samumed presented data on the use of its baldness drug, code-named SM04554, in 300 patients at the American Academy of Dermatology in Washington, D.C. Subjects’ heads were photographed and hairs counted. Those on placebo saw their hair count drop 2.5%. Those who rubbed a 0.15% solution of SM04554 on their heads daily saw hair count increase 9.6%. Those who got a 0.25% solution saw hair count increase 6.9%.

Hair-loss specialists who saw the data were not blown away. Those results aren’t big enough to be certain they’re not occurring by chance or that men will really feel that the product is making their hair grow back. “I think at best they are presenting a trend,” said Daniel Zelac, a dermatologist at the Scripps Center for Integrative Medicine in La Jolla, Calif.

Wilma Bergfeld, a Cleveland Clinic hair-loss expert and past president of the AAD, helped run Samumed’s hair-loss studies. She says it’s too soon to say whether Samumed’s drug is more effective than Rogaine. That drug was introduced in 1988 to a wave of hype–but men still go bald. For most men Rogaine prevents further hair loss but won’t cause a lush regrowth of hair. Samumed’s scalp solution will have to do better.

When it comes to Samumed’s valuation–and medicine as a whole–the arthritis data are far more important. More than 27 million Americans suffer from arthritis as the cartilage that cushions their joints wears away. Every year 700,000 people have their knees replaced with metal joints because their bones have been rubbed raw by age and activity. Another 300,000 get artificial hips.

The largest study of Samumed’s arthritis drug, SM04690, included only 60 patients. Allan Gibofsky, a professor of medicine at Weill Cornell Medical College who advised Samumed, points out that even for small numbers the results line up alluringly: Patients who got SM04690 scored better than those on placebo on two questionnaires that measured how well they functioned and whether their pain improved. On X-rays of patients’ knee joints, the space between the bones seemed to have increased, indicating cartilage might really have grown back.

Still, again, even Samumed’s own consultants say the data are preliminary. More proof will come from a 445-person trial that Samumed aims to complete by the end of the year.

“It’s small and premature,” says Nebojsa Skrepnik, director of research at the Tucson Orthopaedic Institute in Tucson, Ariz., who is helping run the trial. “This is a small number of patients. Yes, you get a good feel for where this is going to go. But can you really make any conclusion that would be valid and withstand scientific scrutiny? Probably not.”

Viewed under the microscope, Samumed looks like a company with a pair of drugs that have not been proved and, if trends in drug discovery hold true, will probably not make it to market. But its investors obviously see something far more wonderful, world-changing and potentially lucrative.

“We can only say that what they told us they would have achieved, they are achieving,” says Bjorn Konig, the head of private equity at the Inter IKEA Group, Samumed’s largest investor. “I suppose money matters to everybody, but the underlying motivation was to build a long-term company whose final goal was to better the lives of people, to alleviate so much pain in this world.”

But Samumed’s investors say the company is already worth as much as BioMarin and Incyte, companies that have marketed products with annual sales of $889 million and $753 million, respectively.

The arthritis drug alone justifies the valuation, insists Finian Tan, a Samumed investor at Vickers Venture Partners who, while at Draper Fisher Jurvetson ePlanet, made a legendary early bet on Baidu. He insists Samumed’s arthritis drug could be the bestselling medicine ever. “Right now I hurt when I run,” he says. “If you can grow one millimeter of cartilage, I’ll go for the jab so long as there are no side effects. I think that if somebody, it doesn’t matter who, can grow cartilage it would be larger than Apple.”

Samumed’s investors do have a case. Sovaldi, the cure for hepatitis C that has generated $32 billion in revenue for Gilead Sciences, was purchased for $11 billion, and that was a single drug. And Samumed is promising something bigger.

Even some of the doubts about Samumed’s drugs offer hope. Both the baldness and arthritis drugs have the same issue: Instead of getting more effective with a higher dose, the drugs have a Goldilocks zone where the medicine works best. That’s a warning sign–it could mean the results are just statistical chance. It could also, as Samumed hopes, just be what happens with Wnt drugs: There’s a perfect dose, and if you hit the pathway too hard, it stops working. One bonus: These drugs seem remarkably safe, because Hood designed them to stay where they’re put–on a bald man’s head or in an arthritic knee–and not to move throughout the body, as most medicines do.

And if these drugs work, it becomes a better bet that some of Samumed’s other medicines will work, too. There’s a treatment for scarring of the lung, known as idiopathic pulmonary fibrosis. And for macular degeneration, which causes blindness. Could these drugs, added together, eventually support a valuation of tens of billions of dollars? Absolutely, though so much has to go right.

But this is certain: Samumed is not Theranos. That company had a business plan that was hard to grasp. How could a disruptor that was going to defeat diagnostics giants LabCorp and Quest by making diagnostic tests cheaper, thereby shrinking the market, be worth as much as LabCorp and Quest? More than that, despite what Theranos says, it looks like it launched its testing technology into wide use before it was ready, potentially putting patients at risk.

Samumed is doing no such thing. Its medicines will reach the market, through the Food & Drug Administration, only after they have proved their effectiveness. If its investors are willing to play the long game and wait for a megahit, good for them. We’ll see the big trials of Samumed’s first drugs over the next year and a half.

After a full day of talking at their San Diego office building–Samumed employs 120 people and has its own labs and rooms full of mice and rats–Kibar and Samikoglu went to a restaurant for sushi. At that point Samikoglu did most of the talking, while Kibar sat quietly, like a man peeking at his cards, sizing up his opponents and waiting for the opportunity to raise his bet.